Cook County Senior Freeze 2025

Cook County Senior Freeze 2025. The senior freeze is available to homeowners 65 years of age with a household income that does not exceed a certain. Taxpayers who received the senior freeze and veterans with disabilities for 2023 will have to reapply for those exemptions.

The cook county senior freeze is a property tax relief program for cook county residents who are 65 years or older, or who are disabled. The senior freeze exemption (senior citizens assessment freeze homestead exemption) allows a qualified senior citizen to apply for a freeze of the equalized assessed value (eav) of their property for the year preceding the year in.

Cook County Senior Freeze 2025 Images References :

%2Fcdn.vox-cdn.com%2Fuploads%2Fchorus_asset%2Ffile%2F22821348%2FSenior_freez_page_1.png) Source: chicago.suntimes.com

Source: chicago.suntimes.com

‘Senior tax freeze’ homeowners told by Cook County Assessor Fritz Kaegi, It allows qualified seniors to defer a.

Source: www.youtube.com

Source: www.youtube.com

How much is the Senior Freeze exemption in Cook county? YouTube, Your local tax rate is determined by the cook county clerk each year, and can be.

Source: www.countyforms.com

Source: www.countyforms.com

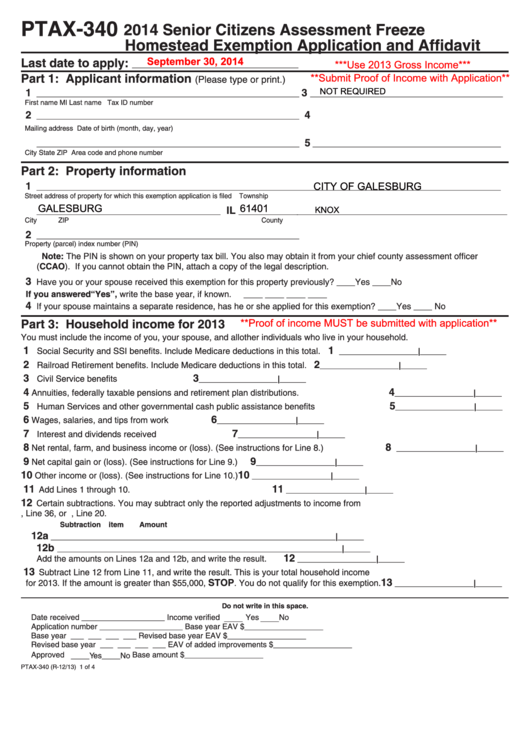

Senior Freeze Exemption Cook County Assessor 2016 Printable Pdf, The program freezes the assessed value of the.

Source: abc7chicago.com

Source: abc7chicago.com

Application deadline extended for Cook County senior property tax, Taxpayers who received the senior freeze and veterans with disabilities for 2023 will have to reapply for those exemptions.

Source: repstephens.com

Source: repstephens.com

DEADLINE TODAY Cook County Senior Citizens Assessment, Retirees and other older homeowners on fixed incomes may reduce their tax bill by taking advantage of senior freeze. to qualify for the “senior freeze” exemption, the applicant must:

Source: www.pdffiller.com

Source: www.pdffiller.com

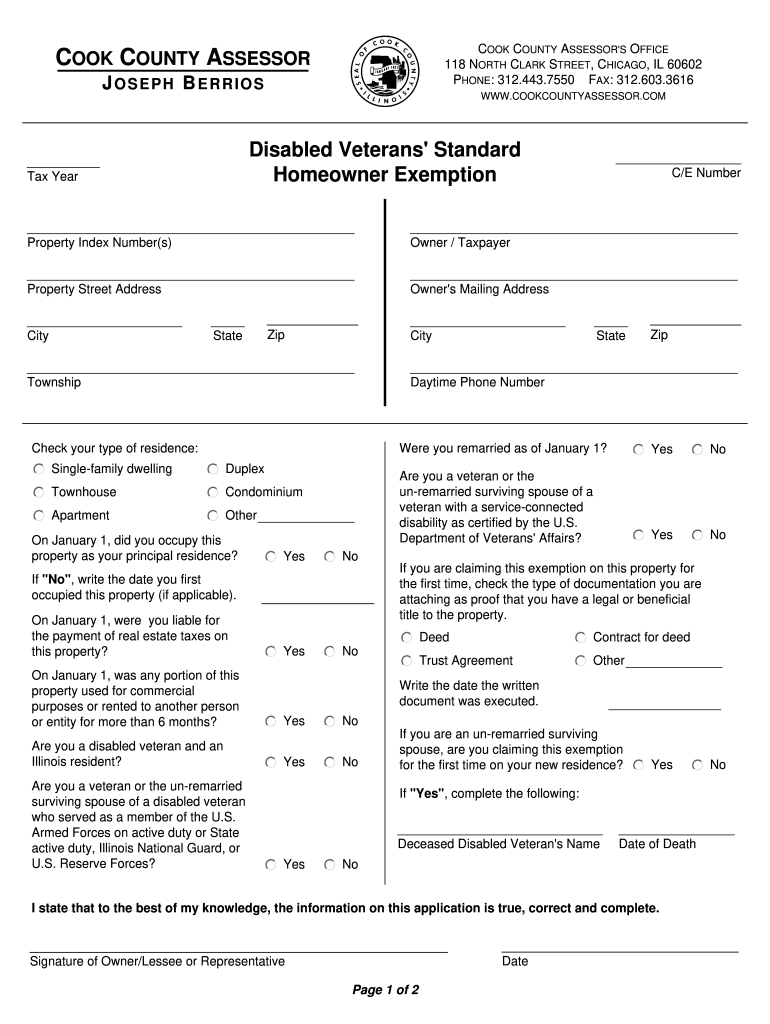

Fillable Online Cook County Assessor Senior Freeze Exemption Form. Cook, Your local tax rate is determined by the cook county clerk each year, and can be.

Source: www.countyforms.com

Source: www.countyforms.com

Form Ptax 340 Senior Citizens Assessment Freeze Homestead Exemption, At the state level, we also want to push for automatic renewal of the senior freeze exemption and renew the affordable housing incentive.

Source: www.califonboro.org

Source: www.califonboro.org

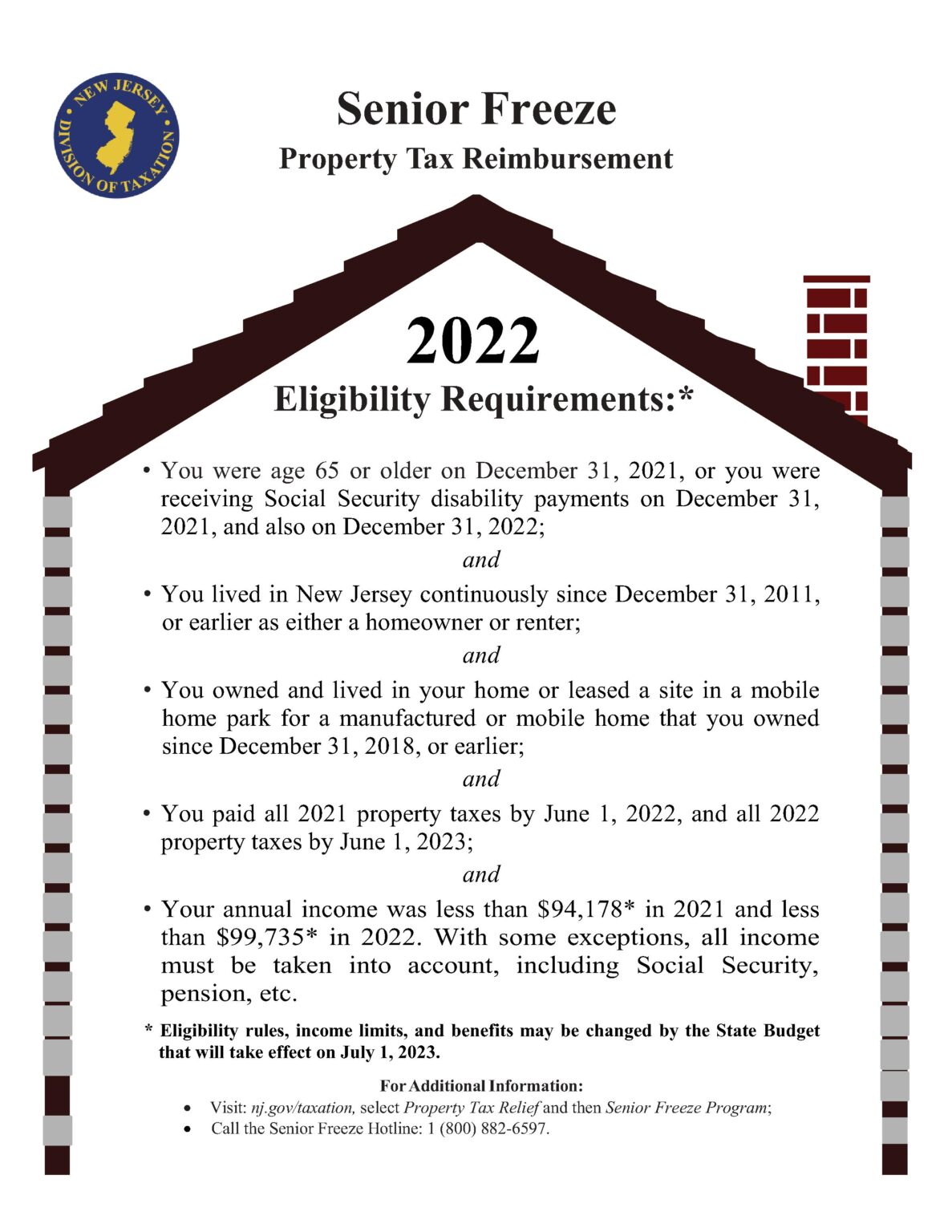

Senior Freeze Property Tax Reimbursement 2022 Califon, New Jersey, Senior homeowners are eligible for this exemption if they are over 65 years of age and have a total household annual income of $65,000 or less in the 2020 calendar year.

Source: karelqwilhelmine.pages.dev

Source: karelqwilhelmine.pages.dev

Cook County Senior Freeze 2024 Vinny Jessalyn, The senior freeze exemption (senior citizens assessment freeze homestead exemption) allows a qualified senior citizen to apply for a freeze of the equalized assessed value (eav) of their property for the year preceding the year in.

Source: www.civicfed.org

Source: www.civicfed.org

Value of the Senior Freeze Homestead Exemption in Cook County Plummeted, Senior homeowners are eligible for this exemption if they are over 65 years of age and have a total household annual income of $65,000 or less in the 2020 calendar year.

Category: 2025